taxing unrealized gains at death

However this policy would. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

What Are Capital Gains Taxes And How Could They Be Reformed

If these households realize 6 trillion of their 75 trillion of that gain during their lifetimes and the remaining 15 trillion at death our proposal would raise almost 2 trillion.

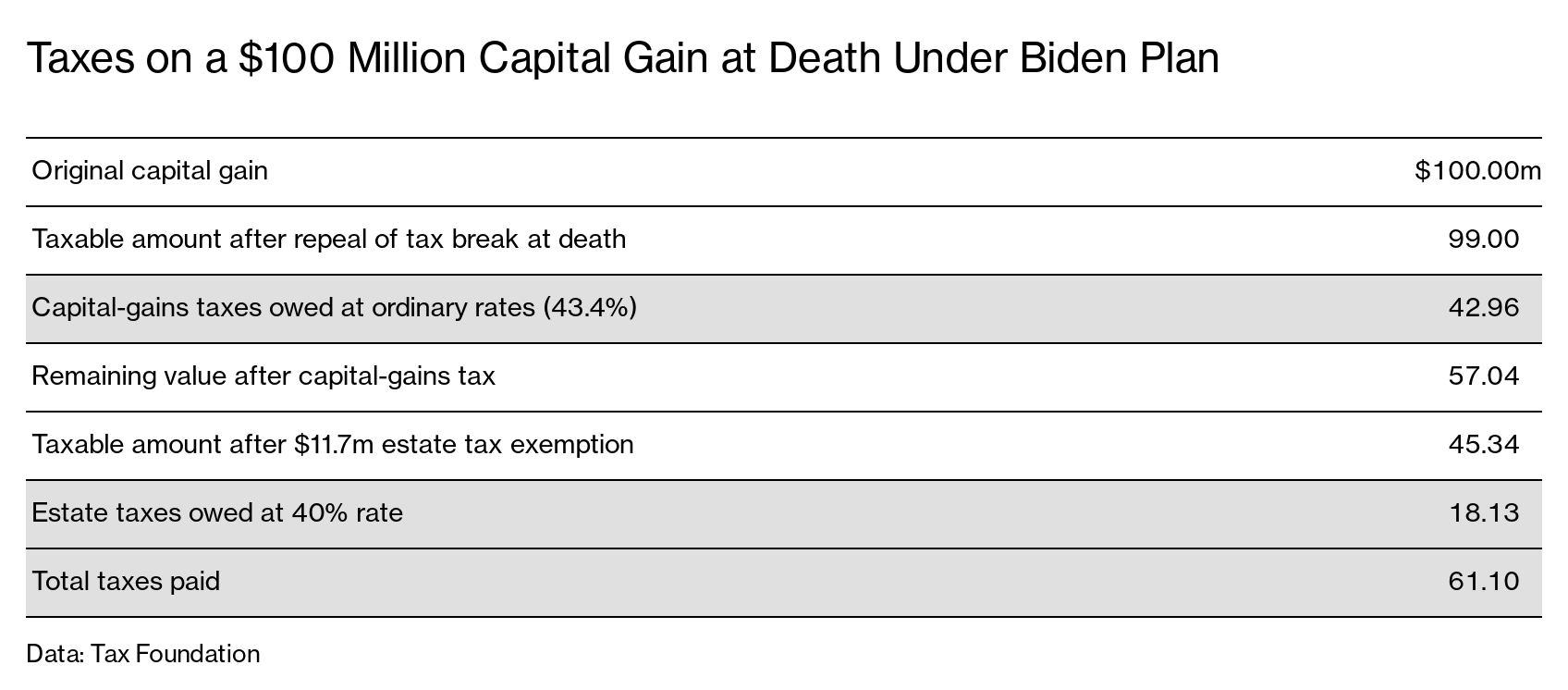

. Taxpayers may also hold onto assets with unrealized capital gains and pass the underlying assets and associated gains to an inheritor at death. There are two proposals for taxing unrealized gains at death. As part of the tax proposals in President Bidens American Families Plan AFP unrealized capital gains over 1 million would be taxed at death.

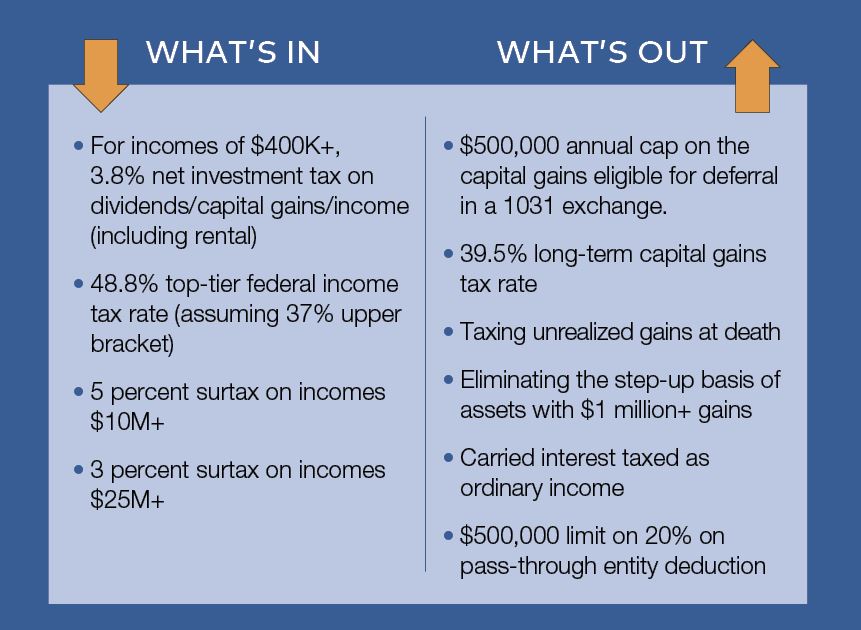

Taxing gains at death would reduce the incentive for older investors to avoid taxes by holding on to assets until death even if those assets are unproductive. When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a. Payroll Taxes Tax Expenditures Credits and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate and Gift Taxes Business.

Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run. More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system To fix this. An article by Harry L.

We estimate that taxing unrealized capital gains at death with a 1 million exemption and increasing the tax rate on capital gains and qualified dividends would raise. Taxing unrealized gains as they accruewhich Congressional Democrats have said is on the table for Americas billionairesor removing the tax code provision allowing heirs. The only way to avoid paying taxes on the unrealized gains is to hold on to the investment indefinitely unless you die in which case the basis for the assets in your estate is.

They recommend a simpler more effective approach. Tax unrealized gains of the wealthy at a higher rate at death than if assets are sold or given as gifts during life. If you decide to sell youd now have 14 in realized capital gains.

Gutman captioned Taxing Gains at Death was published in the January 11 2021 issue of Tax Notes Federal the Gutman Article. We estimate that the average unrealized capital gains estates in. Is taxed at death estate tax to those in which only the unrealized capital gains portion is subject to tax capital gains tax.

More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system To fix. Introduced as legislation would tax capital gains at death with an exemption for the first 1 million of gain. More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system.

Several bills in the 116th CongressHR. In that situation the assets tax. First a capital gains tax on unrealized appreciation may be imposed whenever property is transferred at death.

On May 12 2021 at a.

Avoiding Basis Step Down At Death By Gifting Capital Losses

What To Know About President Joe Biden S New Death Tax Plan Youtube

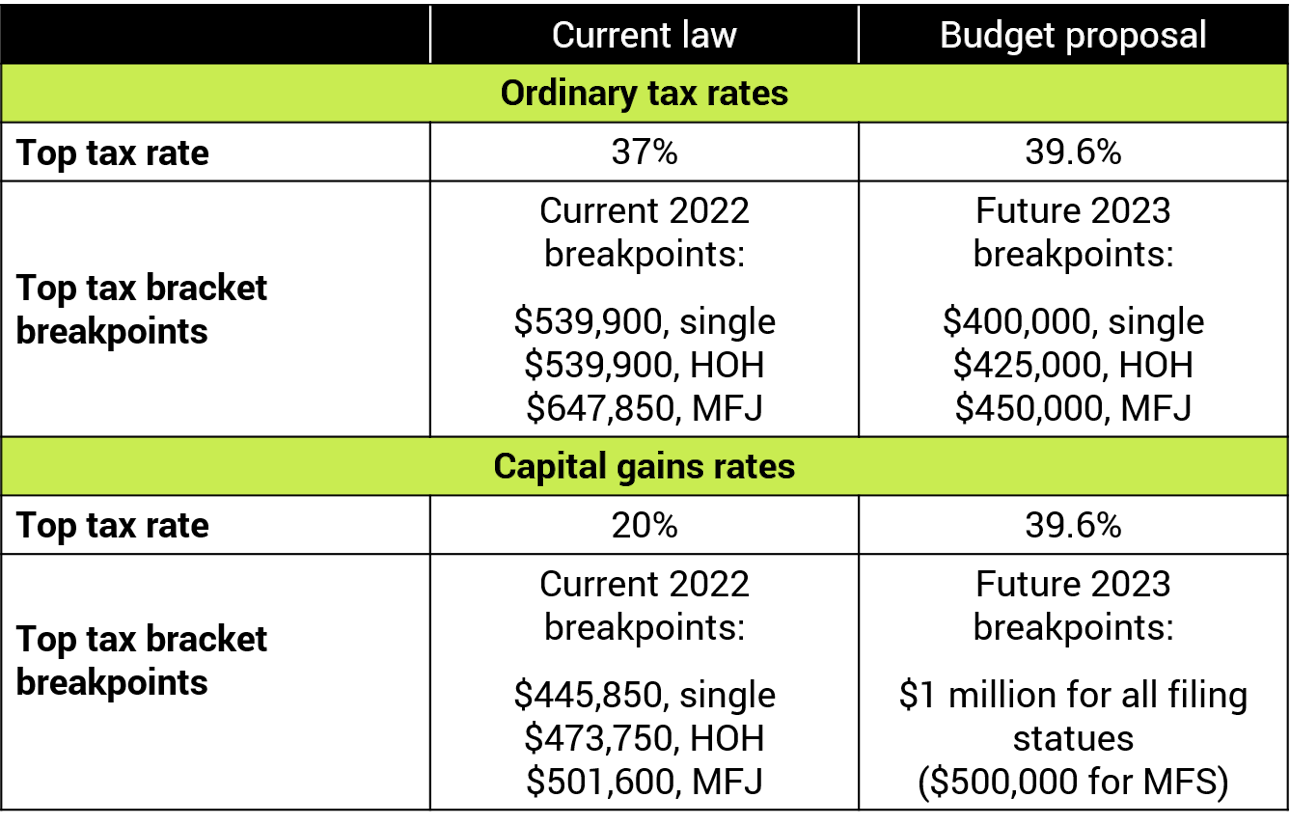

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

U S Capital Gains And Estate Taxation A Status Report And Directions For A Reform Penn Wharton Budget Model

Congressional Progressives Propose Legislation To Tax Unrealized Gains At Death As Republican Bill Seeks Permanent Repeal Of Federal Estate Tax The Real Estate Roundtable

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Democratic Ex Senator Heitkamp Biden Inheritance Tax Plan Would Hurt Family Firms

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Understanding Biden S Proposal To Tax Billionaires Unrealized Gains On Point

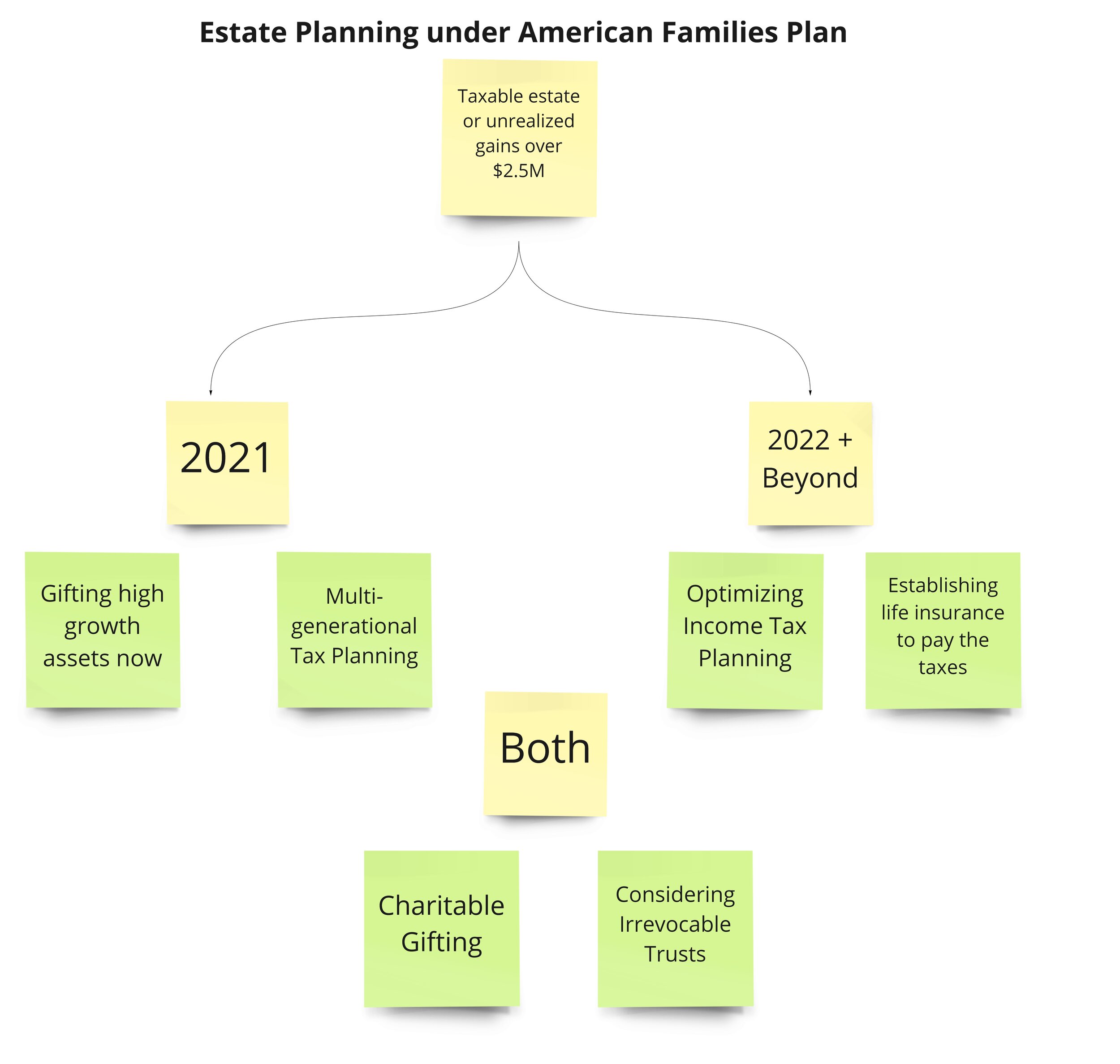

Estate Planning Under The American Families Plan Part 2 Brooklyn Fi

How Could Changing Capital Gains Taxes Raise More Revenue

High Class Problem Large Realized Capital Gains Montag Wealth

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

Joe Biden S New Unrealized Gain Transfer Tax On Your Inheritance Unveiled Youtube